Replace your furnace, ac, or heat pump

Get started today with a quote

Energy-saving HVAC equipment

2023 heat pumps, furnaces & air conditioners

Today’s Heat Pumps, ACs, and Furnaces will comfortably cool and heat your home. Most high-efficiency systems qualify for tax credits. Find out more.

Energy Efficiency

In 2018 the Department of Energy started the first phase of its six-year plan requiring a 13% increase in energy efficiency for air conditioners, heat pumps, and split systems. The second phase of this plan started in January of 2023.

Instant online quote

Get an estimate for your new HVAC equipment by completing a few simple questions about your current Furnace & AC, and your household usage.

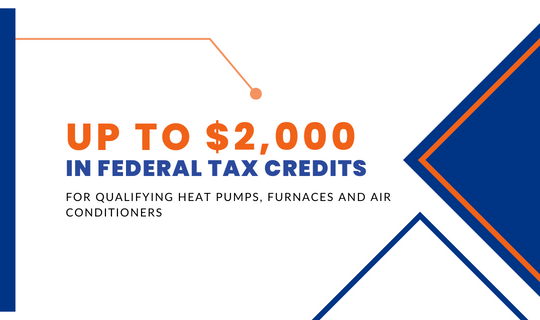

* Valid for qualifying equipment only. Effective Jan 1, 2023: The Inflation Reduction Act of 2022 /The Energy Efficiency Home Improvement Credit 26 USC 25C provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and furnaces, and a maximum of $2,000 for qualified heat pumps. Please consult with your tax advisor.